The All Weather Portfolio is a concept pioneered by Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates.

This portfolio aims to perform well across all economic conditions – be it growth, inflation, deflation, or recession.

In essence, it’s designed to be “weatherproof.”

Origins: How Ray Dalio Came Up with the All Weather Portfolio

Ray Dalio has often emphasized the importance of not trying to predict the future, but rather to prepare for various outcomes.

This approach stems from his understanding of how economies and markets work.

Dalio formulated the All Weather Portfolio based on the belief that certain asset classes have predictable responses to changes in economic conditions.

The All Weather Portfolio focuses on balancing risk, rather than aiming for high returns in a risky way.

It is constructed with a mix of asset classes that can withstand or even prosper under a range of economic situations.

It isn’t designed to outperform in good times; instead, it’s meant to offer steadier, more reliable returns.

At Bridgewater, the All Weather portfolio is managed systematically through decision algorithms to keep it at the optimal balance, but anyone can build one.

All Weather Portfolio Allocation

The All Weather Portfolio is constructed to maintain a certain level of risk across different economic environments.

Here’s the classic allocation strategy Dalio suggests:

- 40% Long-Term Bonds

- 30% Stocks

- 15% Intermediate Term Bonds

- 7.5% Gold

- 7.5% Commodities

These percentages can be adjusted based on individual risk tolerance, economic outlook, or personal financial goals.

Note that the bonds can be split between nominal rate bonds and inflation-linked bonds.

This is especially true in a world with more inflation, larger government deficits, and lower nominal yields.

Creating an All Weather Portfolio with ETFs

ETFs, or Exchange Traded Funds, are ideal for creating an All Weather Portfolio due to their liquidity, cost-effectiveness, and diversification.

Here’s an example of how you could construct the portfolio using ETFs:

- Long-Term Bonds (40%): iShares 20+ Year Treasury Bond ETF (TLT)

- Stocks (30%): Vanguard Total Stock Market ETF (VTI)

- Intermediate Term Bonds (15%): iShares 7-10 Year Treasury Bond ETF (IEF)

- Gold (7.5%): SPDR Gold Shares (GLD)

- Commodities (7.5%): Invesco DB Commodity Index Tracking Fund (DBC)

For inflation-linked bonds, ETFs like TIP or VTIP are available.

Ray Dalio breaks down his “Holy Grail”

Vanguard All Weather Portfolio

Vanguard is a widely trusted investment management company, and it offers several ETF options that could be used to construct an All Weather Portfolio.

For example, you could use:

- Vanguard Long-Term Bond ETF (BLV) for long-term bonds,

- Vanguard Total Stock Market ETF (VTI) for stocks,

- Vanguard Intermediate-Term Bond ETF (BIV) for intermediate-term bonds, and

- Vanguard TIPs ETF (VTIP) for inflation-protected securities

4 Factors Ray Dalio Uses to Construct his All-Weather Portfolio

Fidelity All Weather Portfolio

Fidelity, another respected investment company, also offers various ETFs suitable for building an All Weather Portfolio.

You can use the Fidelity Total Bond ETF (FBND) for your bond allocation and the Fidelity MSCI Real Estate Index ETF (FREL) as part of your stocks.

Fidelity doesn’t offer commodity ETFs, but there are many third-party ETFs available for this purpose.

All Weather Portfolio Performance

Despite its conservative approach, the All Weather Portfolio has shown solid performance over the years.

From 1984 to 2024, the All Weather strategy averaged about 7.6% annual returns with significantly lower volatility than the S&P 500.

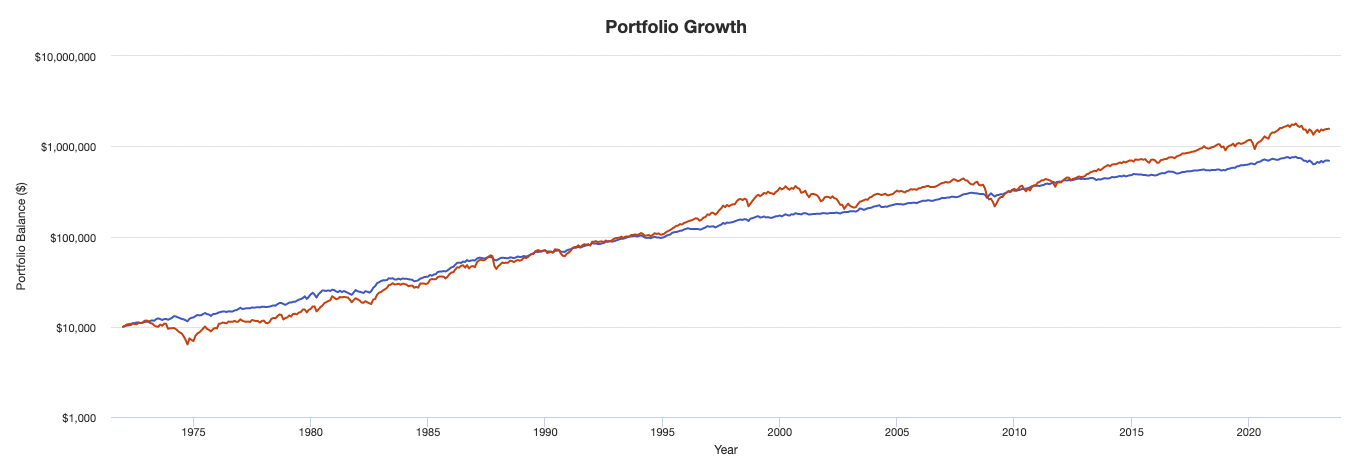

All Weather Portfolio vs S&P 500

While the All Weather Portfolio might not outperform the S&P 500 in bull markets, its real strength lies in mitigating losses during economic downturns.

In the 2008 financial crisis, for example, the All Weather Portfolio would have lost about 4% compared to the S&P 500’s loss of over 35%.

Example Performance of All-Weather Portfolio vs. S&P 500

Let’s take a very simple All Weather Portfolio

- 30% Stocks

- 55% 10-Year Treasuries

- 15% Gold

And let’s compare it to the S&P 500:

Performance Summary

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| All-Weather | $10,000 | $691,246 | 8.59% | 7.58% | 30.16% | -14.35% | -17.54% | 0.54 | 0.85 | 0.66 |

| S&P 500 | $10,000 | $1,560,408 | 10.32% | 15.74% | 37.82% | -37.04% | -50.89% | 0.42 | 0.61 | 1.00 |

You can see better risk-adjusted metrics from the All-Weather Portfolio (i.e., more return per unit of risk) and lower left-tail risk from the lower drawdowns.

Below are some more in-depth statistics:

Risk and Return Metrics of All-Weather Portfolio vs. S&P 500

| Metric | All-Weather Portfolio | S&P 500 |

|---|---|---|

| Arithmetic Mean (monthly) | 0.71% | 0.93% |

| Arithmetic Mean (annualized) | 8.89% | 11.70% |

| Geometric Mean (monthly) | 0.69% | 0.82% |

| Geometric Mean (annualized) | 8.59% | 10.32% |

| Standard Deviation (monthly) | 2.19% | 4.54% |

| Standard Deviation (annualized) | 7.58% | 15.74% |

| Downside Deviation (monthly) | 1.18% | 2.96% |

| Maximum Drawdown | -17.54% | -50.89% |

| Stock Market Correlation | 0.66 | 1.00 |

| Beta(*) | 0.32 | 1.00 |

| Alpha (annualized) | 5.02% | 0.00% |

| R2 | 43.60% | 100.00% |

| Sharpe Ratio | 0.54 | 0.42 |

| Sortino Ratio | 0.85 | 0.61 |

| Treynor Ratio (%) | 12.94 | 6.68 |

| Calmar Ratio | 0.06 | 0.48 |

| Active Return | -1.73% | 0.00% |

| Tracking Error | 12.15% | 0.00% |

| Information Ratio | -0.14 | N/A |

| Skewness | 0.07 | -0.52 |

| Excess Kurtosis | 1.26 | 1.92 |

| Historical Value-at-Risk (5%) | 2.74% | 7.14% |

| Analytical Value-at-Risk (5%) | 2.89% | 6.55% |

| Conditional Value-at-Risk (5%) | 3.97% | 10.11% |

| Upside Capture Ratio (%) | 40.95 | 100.00 |

| Downside Capture Ratio (%) | 21.81 | 100.00 |

| Safe Withdrawal Rate | 4.86% | 4.31% |

| Perpetual Withdrawal Rate | 4.29% | 5.81% |

| Positive Periods | 394 out of 617 (63.86%) | 385 out of 617 (62.40%) |

| Gain/Loss Ratio | 1.32 | 1.02 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are monthly values. | ||

FAQs – Ray Dalio All Weather Portfolio

1. What is the Ray Dalio All Weather Portfolio?

The All Weather Portfolio is an investment strategy popularized by Ray Dalio, the founder of Bridgewater Associates, one of the world’s largest hedge funds.

The strategy is designed to perform well across all economic conditions, hence the name “All Weather”.

It is a diversified asset mix which seeks to deliver decent returns without exposing the investor to excessive risk.

The example portfolio that Dalio gave to Tony Robbins is divided into 40% Long Term Bonds, 30% Stocks, 15% Intermediate Term Bonds, 7.5% Gold, and 7.5% Commodities.

2. Why is it called the “All Weather” Portfolio?

The portfolio is designed to weather any storm in the financial markets.

The portfolio’s underlying philosophy is that it balances risk across different types of economic scenarios – growth, inflation, recession, or deflation.

By being prepared for all economic conditions, the portfolio aims to provide consistent returns regardless of the market environment.

3. How does the All Weather Portfolio minimize risk?

The portfolio minimizes risk through diversification.

By investing across different asset classes – such as bonds, stocks, gold, and other commodities – it reduces the potential for catastrophic losses in any single asset class.

This strategy helps to stabilize returns as different assets often perform differently in varying market conditions.

4. What is the expected return from the All Weather Portfolio?

The exact return of the All Weather Portfolio can vary based on market conditions.

Historically, the portfolio has delivered solid returns with less volatility compared to a traditional 60/40 stock/bond portfolio.

It’s important to note, however, that past performance does not guarantee future results, and the All Weather Portfolio, like any investment, comes with its own set of risks.

5. Can I use the All Weather Portfolio for my retirement savings?

The All Weather Portfolio can be a suitable choice for retirement savings as it aims for steady growth with reduced volatility.

However, every individual’s situation is different, and factors such as risk tolerance, investment horizon, and financial goals should be considered.

It’s always advisable to consult with a financial advisor before making significant investment decisions.

6. How often should I rebalance my All Weather Portfolio?

Generally, the All Weather Portfolio should be rebalanced at least once a year.

However, this could depend on the rules set by your investment advisor or your personal investment policy.

The purpose of rebalancing is to maintain the target allocation in your portfolio and ensure it continues to reflect your investment objectives and risk tolerance.

7. How does the All Weather Portfolio perform during a recession?

The All Weather Portfolio is designed to weather various economic scenarios, including recessions.

The inclusion of different asset classes, particularly bonds and gold, can provide a cushion during downturns.

However, like all investment strategies, it isn’t immune to losses.

During a severe market downturn, the portfolio could still experience losses, although potentially less severe than a portfolio heavily weighted in equities.

8. Is the All Weather Portfolio only for US investors?

No, the All Weather Portfolio can be adapted by investors globally.

While the original portfolio proposed by Ray Dalio is based on US assets, the concept of risk balancing across various asset classes can be applied in other markets.

International investors can substitute US bonds and stocks with their local or regional equivalents.

9. Is the All Weather Portfolio the right strategy for everyone?

While the All Weather Portfolio is a robust investment strategy, it’s not necessarily suitable for everyone.

This strategy suits investors seeking lower risk and more consistent returns.

However, it may not be as appealing to investors willing to take on more risk for potentially higher returns.

It’s crucial to align your investment strategy with your personal financial goals, risk tolerance, and investment horizon.

Consulting with a financial advisor can help determine if the All Weather Portfolio or an alternative strategy is the right fit for your individual circumstances.