When it comes to investing, one of the most critical strategies is to build a balanced portfolio.

This approach can help mitigate risk while providing a strong potential for returns.

In this article, we will explore the different aspects of creating a balanced portfolio, from asset allocation to age-based strategies, ETFs, and examples of well-balanced portfolios.

What is a Balanced Portfolio?

A balanced portfolio is an investment strategy that involves diversification across different asset classes such as stocks, bonds, commodities, and cash equivalents.

The goal is to spread risk across various investments to protect against market volatility and potential losses.

Balanced Portfolio Asset Allocation

Asset allocation plays a crucial role in building a balanced portfolio.

It involves determining how much of your investment funds should be distributed among various asset classes, such as stocks, bonds, and cash.

A balanced portfolio typically includes a mix of both fixed-income securities (bonds) and equities (stocks).

Depending on your risk tolerance, time horizon, and financial goals, you might have a different asset allocation.

For example, a younger investor with a high risk tolerance may have a more aggressive portfolio allocation model, with a higher percentage of stocks.

In contrast, an older investor nearing retirement might opt for a more conservative allocation, favoring bonds and other less risky investments.

Here’s a classic allocation strategy suggested by Ray Dalio, a common proponent of building a balanced portfolio:

- 40% Long-Term Bonds

- 30% Stocks

- 15% Intermediate-Term Bonds

- 7.5% Gold

- 7.5% Commodities

A Balanced Portfolio Will Always Make Money | Ray Dalio Interview

Other Balanced Portfolio Allocations

Example #1

- Inflation Bonds: 25%

- Global Stocks: 25%

- Cash: 0%

- Commodities: 5%

- Gold: 15%

- EM Bonds (Unhedged): 5%

- EM Stocks: 5%

- Corporate Bonds: 7.5%

- DM Gov’t Bonds: 7.5%

Example #2

- Inflation Bonds: 20%

- Global Stocks: 30%

- Cash: 5%

- Commodities: 10%

- Gold: 10%

- EM Bonds (Unhedged): 5%

- EM Stocks: 5%

- Corporate Bonds: 5%

- DM Gov’t Bonds: 10%

Example #3

- Inflation Bonds: 15%

- Global Stocks: 20%

- Cash: 10%

- Commodities: 5%

- Gold: 20%

- EM Bonds (Unhedged): 10%

- EM Stocks: 5%

- Corporate Bonds: 10%

- DM Gov’t Bonds: 5%

Example #4

- Inflation Bonds: 30%

- Global Stocks: 20%

- Cash: 0%

- Commodities: 10%

- Gold: 10%

- EM Bonds (Unhedged): 5%

- EM Stocks: 10%

- Corporate Bonds: 5%

- DM Gov’t Bonds: 10%

These allocations offer various strategies to diversify and balance the portfolio in response to different economic conditions and risk appetites.

Balanced Portfolio by Age

Balanced portfolio by age refers to adjusting the asset allocation based on the investor’s age.

As you get older, your risk tolerance typically decreases, leading to a shift from higher-risk investments like stocks to lower-risk ones like bonds.

A popular approach to age-based asset allocation is the “100 minus age” rule.

This suggests that the percentage of your portfolio invested in stocks should be equivalent to 100 minus your age.

The rest should be allocated to lower-risk investments.

For instance, if you’re 30, you would allocate 70% of your portfolio to stocks and 30% to bonds.

Asset Allocation Models by Age

There are various asset allocation models that investors can use to create a balanced portfolio.

They can be conservative, moderate, or aggressive.

Conservative models typically favor more bonds, while aggressive ones lean towards stocks.

As an investor ages, they typically move from aggressive to more conservative models.

Remember, these models are guidelines and may not be perfect for everyone.

It’s essential to consider your unique financial goals and risk tolerance when selecting a model.

Balanced Portfolio ETF

Exchange-Traded Funds (ETFs) can be an effective way to achieve a balanced portfolio.

ETFs are investment funds that trade on stock exchanges, similar to individual stocks.

They offer a way to invest in a wide range of assets, making them ideal for diversification.

For example, the Vanguard ETF balanced portfolio offers a combination of stocks and bonds in one fund, allowing investors to achieve a balanced portfolio with a single investment.

For example, you could use:

- Vanguard Long-Term Bond ETF (BLV) for long-term bonds,

- Vanguard Total Stock Market ETF (VTI) for stocks,

- Vanguard Intermediate-Term Bond ETF (BIV) for intermediate-term bonds, and

- Vanguard TIPs ETF (VTIP) for inflation-protected securities

Fidelity Balanced Portfolio

Fidelity is another investment firm that offers balanced portfolio options.

Fidelity Balanced Fund, for instance, aims to provide income and capital growth by investing approximately 60% of assets in stocks and 40% in bonds.

This approach provides diversification and a balance between risk and reward.

Index Fund Asset Allocation Models

Index funds are a type of mutual fund or ETF that aims to replicate the performance of a specific market index.

They offer diversification and a passive investment approach, making them a popular choice for a balanced portfolio.

You can build a balanced portfolio using various index funds to represent different asset classes.

For instance, you could use a broad market index fund for your stock allocation, a bond index fund for your bond allocation, and so forth.

Best Balanced Portfolio in Retirement

In retirement, a balanced portfolio typically leans more heavily on bonds and other fixed-income investments to provide income and preserve capital.

However, some allocation to stocks can still be beneficial for growth and to keep up with inflation.

The best balanced portfolio in retirement depends on individual factors like risk tolerance, income needs, and other assets.

However, a common approach might be a 40% allocation to stocks and 60% to bonds.

Balanced Stock Portfolio

A balanced stock portfolio involves diversifying across different sectors and company sizes.

This can help mitigate the risks associated with the stock market, such as sector-specific downturns.

You can achieve a balanced stock portfolio by investing in individual stocks across various sectors or through ETFs and mutual funds that offer broad market exposure.

AST Balanced Asset Allocation Portfolio

The AST Balanced Asset Allocation Portfolio is a fund that offers a diversified mix of equities and fixed-income securities.

It aims to balance the potential for growth offered by equities with the stability and income offered by fixed-income securities.

Well-Balanced Portfolio Examples

A well-balanced portfolio will look different for everyone based on their financial goals, risk tolerance, and investment horizon.

However, here are two examples:

- Young Investor: An investor in their 20s or 30s might have a higher risk tolerance and a longer time horizon. Their portfolio could include 80% equities (split across different sectors and regions) and 20% bonds.

- Near-Retirement Investor: An investor in their 60s might have a lower risk tolerance and shorter investment horizon. Their portfolio could include 40% equities, 50% bonds, and 10% cash or cash equivalents.

Building a balanced portfolio involves careful consideration of your financial goals, risk tolerance, and investment horizon.

Remember to regularly review and rebalance your portfolio to ensure it stays aligned with your objectives.

Always consider seeking advice from a financial advisor if you’re unsure.

How Does a Balanced Portfolio Compare to an Unbalanced One?

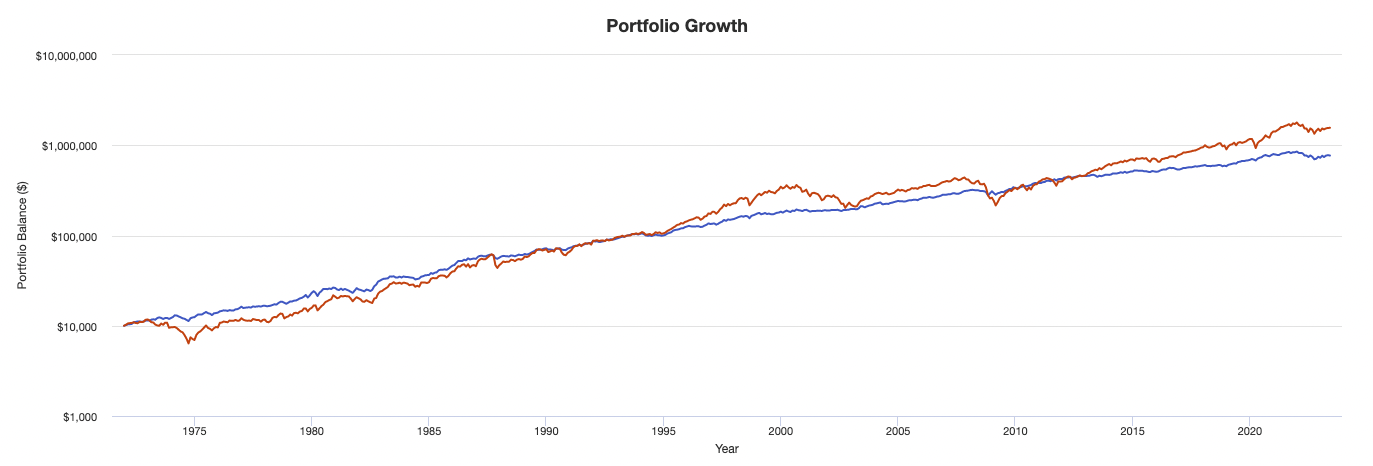

Let’s take a simple balanced portfolio of:

- 35% stocks

- 50% bonds

- 15% gold

Versus:

- 100% stocks (S&P 500)

Performance Summary

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| Balanced | $10,000 | $769,806 | 8.81% | 7.88% | 29.20% | -14.57% | -18.00% | 0.55 | 0.85 | 0.73 |

| S&P 500 | $10,000 | $1,560,408 | 10.32% | 15.74% | 37.82% | -37.04% | -50.89% | 0.42 | 0.61 | 1.00 |

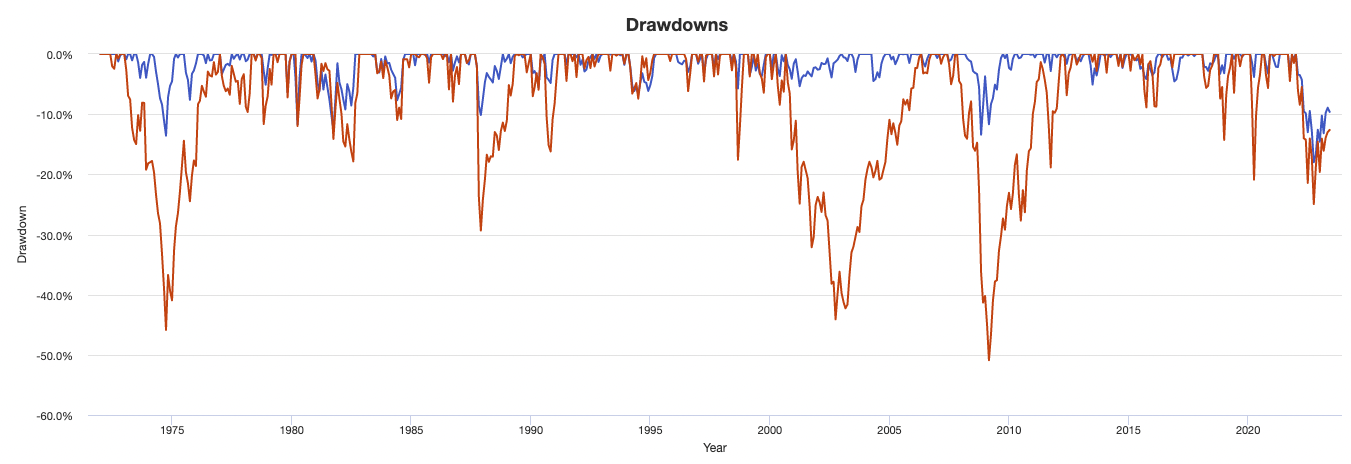

We can see much better risk-adjusted performance in the case of the balanced portfolio, half the volatility, and much shallower drawdowns.

In the chart below, the blue line represents the balanced portfolio while the red line represents the unbalanced portfolio.

Portfolio Growth

Drawdowns

And some more in-depth performance statistics:

Risk and Return Metrics

| Metric | Balanced | S&P 500 |

|---|---|---|

| Arithmetic Mean (monthly) | 0.73% | 0.93% |

| Arithmetic Mean (annualized) | 9.15% | 11.70% |

| Geometric Mean (monthly) | 0.71% | 0.82% |

| Geometric Mean (annualized) | 8.81% | 10.32% |

| Standard Deviation (monthly) | 2.27% | 4.54% |

| Standard Deviation (annualized) | 7.88% | 15.74% |

| Downside Deviation (monthly) | 1.25% | 2.96% |

| Maximum Drawdown | -18.00% | -50.89% |

| Stock Market Correlation | 0.73 | 1.00 |

| Beta(*) | 0.37 | 1.00 |

| Alpha (annualized) | 4.72% | 0.00% |

| R2 | 53.37% | 100.00% |

| Sharpe Ratio | 0.55 | 0.42 |

| Sortino Ratio | 0.85 | 0.61 |

| Treynor Ratio (%) | 11.89 | 6.68 |

| Calmar Ratio | 0.11 | 0.48 |

| Active Return | -1.51% | 0.00% |

| Tracking Error | 11.34% | 0.00% |

| Information Ratio | -0.13 | N/A |

| Skewness | -0.02 | -0.52 |

| Excess Kurtosis | 1.27 | 1.92 |

| Historical Value-at-Risk (5%) | 2.87% | 7.14% |

| Analytical Value-at-Risk (5%) | 3.01% | 6.55% |

| Conditional Value-at-Risk (5%) | 4.17% | 10.11% |

| Upside Capture Ratio (%) | 45.05 | 100.00 |

| Downside Capture Ratio (%) | 27.41 | 100.00 |

| Safe Withdrawal Rate | 4.97% | 4.31% |

| Perpetual Withdrawal Rate | 4.50% | 5.81% |

| Positive Periods | 394 out of 617 (63.86%) | 385 out of 617 (62.40%) |

| Gain/Loss Ratio | 1.30 | 1.02 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are monthly values. | ||

FAQ – Balanced Portfolio: How to Build One

What is a balanced portfolio?

A balanced portfolio refers to an investment strategy that aims to achieve a mix of asset classes, such as stocks, bonds, and cash equivalents, in order to minimize risk while seeking moderate returns.

The goal is to create a diversified investment portfolio that can weather different market conditions.

Why is building a balanced portfolio important?

Building a balanced portfolio is crucial because it helps mitigate risk by diversifying investments across various asset classes.

By spreading investments across different types of assets, you reduce the potential impact of any single investment performing poorly.

This approach promotes long-term stability and can provide a smoother investment journey.

What are the key components of a balanced portfolio?

A balanced portfolio typically includes a combination of stocks, bonds, commodities, and cash equivalents.

Stocks offer potential growth but come with higher volatility, while bonds provide stability and income.

Commodities can protect against inflation and currency devaluation.

Cash equivalents, such as money market funds or short-term treasury bills, offer liquidity and serve as a safe haven during uncertain times.

How do I determine the asset allocation for a balanced portfolio?

Determining the asset allocation for a balanced portfolio depends on various factors, including your risk tolerance, investment goals, time horizon, and financial situation.

Generally, a common approach is to allocate a percentage of your portfolio to each asset class based on their historical performance and expected future returns.

How can I assess my risk tolerance?

Assessing your risk tolerance involves evaluating your ability and willingness to withstand potential investment losses.

Consider factors such as your financial goals, time horizon, investment knowledge, and comfort level with market fluctuations.

Online risk tolerance questionnaires or consulting with a financial advisor can help in determining your risk tolerance level.

What strategies can I use to build a balanced portfolio?

Several strategies can be used to build a balanced portfolio.

Some common strategies include:

- All-Weather Portfolio (balancing assets based on their risks rather than dollar amounts)

- the 60/40 strategy (allocating 60% to stocks and 40% to bonds)

- the core-satellite approach (core holdings in diversified funds supplemented by satellite holdings in individual stocks or sectors), or

- the target-date fund strategy (choosing a fund that automatically adjusts its asset allocation based on your target retirement date).

How often should I rebalance my balanced portfolio?

Rebalancing involves adjusting the asset allocation of your portfolio back to its original targets.

The frequency of rebalancing depends on your investment strategy and market conditions.

Some investors rebalance on a specific time schedule (e.g., annually or semi-annually), while others do it when their asset allocation drifts significantly from the desired targets (e.g., exceeding a certain percentage threshold).

Should I consider international investments in my balanced portfolio?

Including international investments in a balanced portfolio can provide additional diversification and potential growth opportunities.

International investments expose you to different markets, currencies, and economies.

However, it’s important to assess the risks associated with investing in specific countries or regions, and consider factors such as geopolitical stability, currency fluctuations, and regulatory environments.

What role does risk management play in a balanced portfolio?

Risk management is a critical aspect of building and maintaining a balanced portfolio.

It involves analyzing and understanding the risks associated with different investments, diversifying across asset classes, and implementing strategies like asset allocation, diversification, and periodic rebalancing to mitigate risks.

Regular monitoring of your portfolio’s performance is also crucial to ensure it remains aligned with your risk tolerance and investment objectives.

Should I seek professional advice to build a balanced portfolio?

While it’s not mandatory, seeking professional advice from a financial advisor can be beneficial when building a balanced portfolio.

A financial advisor can help assess your financial situation, goals, and risk tolerance, and provide personalized recommendations based on your unique circumstances.

They can also help monitor and adjust your portfolio over time to keep it on track with your objectives.

Building a balanced portfolio is a personalized process, and the answers to these questions may vary based on individual circumstances.

It’s important to educate yourself, conduct thorough research, and consider professional advice before making any investment decisions.